LinkDaddy GBP Management Devices and Techniques

LinkDaddy GBP Management Devices and Techniques

Blog Article

Reinventing Your Approach to GBP Administration

In the world of international economic markets, taking care of the British Extra pound (GBP) calls for a meticulous and strategic approach that goes beyond conventional methods. As the characteristics of the GBP market proceed to advance, specialists are charged with reassessing their administration methods to stay ahead of the curve.

Understanding GBP Market Characteristics

The understanding of GBP market characteristics is vital for making notified decisions in international exchange trading. The GBP, also recognized as the British Extra pound, is one of the most traded currencies in the globe.

Economic indications play a considerable role in forming the GBP's performance. Trick elements to monitor consist of GDP growth, rising cost of living rates, joblessness figures, and rate of interest choices by the Bank of England. Favorable economic data typically reinforces the pound, while adverse data can cause depreciation.

Geopolitical events can additionally impact the GBP's worth. Brexit, for example, has actually been a significant chauffeur of volatility in recent times (google business profile management). Adjustments in government policies, profession arrangements, and worldwide occasions can all affect market sentiment and the GBP's direction

Applying Risk Monitoring Strategies

Leveraging Innovation for GBP Evaluation

Making use of innovative technical tools enhances the precision and efficiency of examining GBP market fads and characteristics. AI formulas can recognize patterns and relationships in the GBP market, providing valuable insights for decision-making.

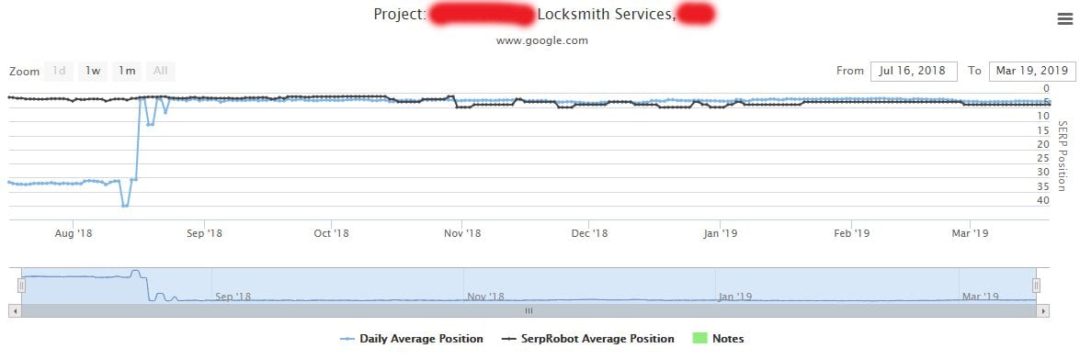

Additionally, data visualization devices play an essential duty in streamlining complicated data sets right into conveniently absorbable charts and graphes. These tools make it possible for experts to spot patterns, anomalies, and chances rapidly. Device understanding algorithms can be trained to predict GBP market movements based on historical information, helping to assist tactical decisions.

Branching Out GBP Investment Portfolios

With a strong structure in leveraging innovation for GBP analysis, economic specialists can now purposefully branch out GBP investment portfolios to enhance returns and mitigate dangers. Diversity is a basic concept that involves spreading financial investments across different asset classes, industries, and geographic regions. site here By diversifying a GBP portfolio, capitalists can decrease the influence of volatility in any kind of single property or market sector, potentially improving overall performance.

One reliable method to expand a GBP financial investment portfolio is by assigning possessions throughout various kinds of safety and securities such as equities, bonds, realty, and assets. This strategy can help stabilize the portfolio's risk-return account, as different property courses tend to behave in a different way under numerous market conditions.

Tracking GBP Efficiency Metrics

To successfully examine the efficiency of a GBP financial investment portfolio, financial professionals have to concentrate on essential efficiency metrics that offer insights right into its profitability and danger monitoring. Tracking GBP efficiency metrics is crucial for making notified choices and optimizing profile end results.

Volatility metrics such as standard variance and beta are likewise essential indicators of danger. Conventional discrepancy gauges the diffusion of returns, highlighting the portfolio's stability or irregularity, while beta assesses its sensitivity to market movements. Comprehending these metrics can help in taking care of threat exposure and readjusting the portfolio's appropriation to satisfy wanted threat degrees.

In addition, tracking metrics like Sharpe ratio, information proportion, and drawdown evaluation can offer deeper insights right into risk-adjusted returns and downside security. By methodically monitoring these efficiency metrics, financial experts can make improvements GBP investment strategies, boost performance, and much better browse market changes.

Conclusion

Finally, revolutionizing the approach to GBP management includes understanding market dynamics, implementing danger monitoring strategies, leveraging innovation for evaluation, expanding financial investment portfolios, and keeping track of efficiency metrics. By integrating these essential components into your GBP monitoring method, you can enhance your decision-making process and attain better success in navigating the complexities of the GBP market.

With a solid structure in leveraging technology for GBP evaluation, economic specialists can now tactically expand GBP investment profiles to enhance returns and reduce risks.

Report this page